💸 The 1.75% Instant Deposit Fee That Wasn’t So “Instant”

If you’re a small business owner using QuickBooks, you may want to take a closer look at what you’re really signing up for. Behind the sleek dashboard and familiar branding lies a troubling pattern of undisclosed fees, forced arbitration clauses, and class action waivers—all designed to protect Intuit, not you.

For many users, QuickBooks’ Instant Deposit feature may sound like a helpful tool: get your money faster, keep cash flow moving. But what isn't clear if you get opted into this service is that a 1.75% fee is deducted from every deposit, often without clear upfront disclosure.

If this gets activated on your account these fees are not optional, and many users—myself included—had no idea how much was being siphoned from their earnings until thousands had been lost. There is no meaningful way to opt out once you’re in, and no refund policy in place for what many consider to be deceptively applied charges. Most vendors offer 24 hour deposits for free as a default. QuickBooks charges a fee for “Instant Deposit” — but the transfers aren’t always instant. You’ll still get hit with the 1.75% fee, even if your funds take hours or longer to arrive.

⚖️ Buried in Legal Fine Print: Waiving Your Rights

Things get even more alarming when you try to dispute these fees. QuickBooks will point you to their Terms of Service, which contain some deeply concerning legal waivers:

- You agree to mandatory arbitration, meaning you cannot sue them in court.

- You waive your right to a jury trial.

- You are barred from joining a class action lawsuit, even if thousands of other users are affected.

Even worse? These waivers remain in effect even if Intuit terminates your account. That means they could wrongfully shut you down—and you’d still have no right to hold them accountable in a public forum.

🕵️ A Dark Pattern by Design

These aren’t just harmless technicalities. They’re dark patterns—carefully crafted legal and UX strategies meant to protect corporations at the expense of consumers.

The forced arbitration clause isn’t something you actively agree to in most cases. It’s buried in fine print, hidden behind multiple links, and buried deep in the onboarding process. Many users didn’t even know they were waiving their legal rights until they tried to fight back.

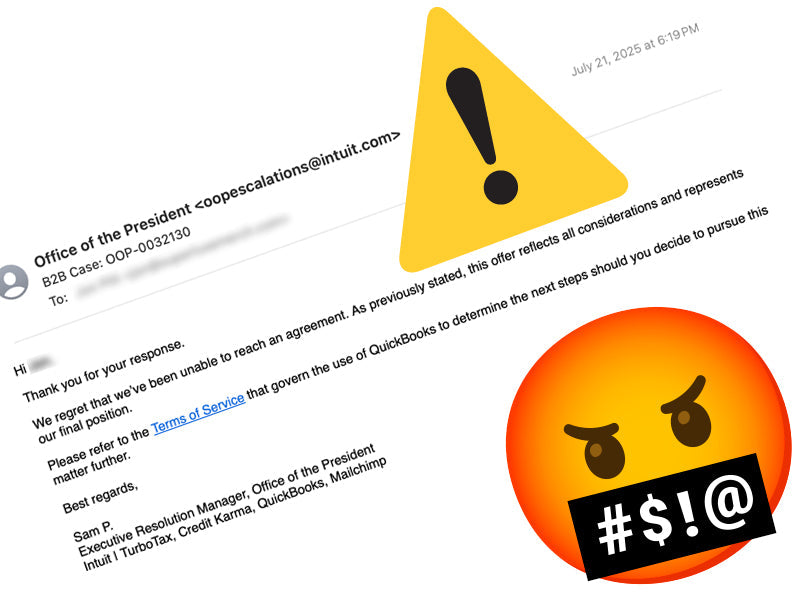

❌ A Pattern of Corporate Evasion

When I contacted QuickBooks’ Executive Office to dispute over $11,000 in Instant Deposit fees, I was met with a templated, final response:

“Please refer to our Terms of Service. This is our final position.”

No refund. No accountability. No way forward.

This is part of a wider issue affecting thousands of small business owners—people who trusted QuickBooks with their finances, only to be blindsided by fees and blocked from seeking justice.

🧭 What Can You Do?

If you’ve been affected, here’s what you can do:

- File a complaint with the FTC, CFPB, and your state attorney general.

- Post publicly about your experience using hashtags like #QuickBooks, #ForcedArbitration, and #DarkPatterns.

- Switch platforms and look for accounting software that puts transparency first.

- Demand change: Tag Intuit’s leadership team (@sasan_goodarzi, @Intuit) and call for them to remove predatory legal clauses.

🚨 Final Thoughts

The QuickBooks debacle isn’t just about fees—it’s about corporate overreach, legal traps, and the erosion of consumer rights. Small business owners deserve better than being nickel-and-dimed by a company that hides behind Terms of Service and legal waivers.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.